Cost-Effective

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

Simple solutions from home, fast. Instant money in your account and flexible loan terms

Submit an application via our app. Just fill out a simple form.

Hold on for our response, coming in just 15 minutes.

Receive your money, typically transferred within a minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

In recent years, instant mobile loans have become increasingly popular in Kenya. These loans provide quick and convenient access to funds for individuals in need of financial assistance. Whether you need money for emergencies, business ventures, or personal expenses, instant mobile loans offer a convenient solution.

One of the key benefits of instant mobile loans is their convenience and speed. With just a few clicks on your phone, you can apply for a loan and receive the funds within minutes. This is particularly helpful in emergency situations where time is of the essence.

These factors make instant mobile loans a convenient option for those in urgent need of financial assistance.

Another advantage of instant mobile loans is the flexibility in loan amounts. Depending on your needs and repayment capabilities, you can borrow varying amounts of money. This allows borrowers to tailor their loans to suit their specific financial circumstances.

Instant mobile loans are accessible to all individuals, regardless of their financial status. Whether you are employed, self-employed, or a student, you can easily qualify for a loan through your mobile phone. This inclusivity makes instant mobile loans a popular choice among Kenyans looking for quick financial assistance.

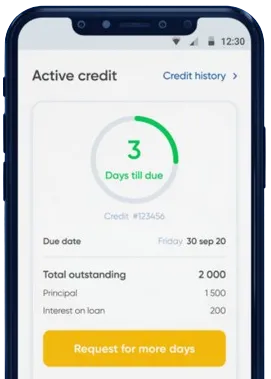

Instant mobile loans in Kenya typically have transparent terms and conditions, making it easy for borrowers to understand the cost of borrowing. Interest rates and repayment schedules are clearly outlined, ensuring that borrowers are informed before committing to a loan.

Instant mobile loans in Kenya offer a convenient and efficient way to access quick funds when needed. With their speed, flexibility, accessibility, and transparent terms, these loans provide a valuable financial lifeline for individuals facing unexpected expenses or cash shortages.

Instant mobile loans in Kenya are short-term loans that are disbursed directly to your mobile phone through mobile money platforms such as M-Pesa. These loans are convenient and quick to access, usually requiring minimal paperwork.

To apply for an instant mobile loan in Kenya, you typically need to download a mobile loan app, register with your phone number, and provide some personal information. You may also need to grant the app permission to access your mobile money account.

The eligibility criteria for instant mobile loans in Kenya may vary depending on the lender, but generally, you need to be a Kenyan citizen or resident, have a valid national ID, be of legal age, and have an active mobile money account.

Once your loan application is approved, the funds are usually disbursed to your mobile money account instantly or within a few minutes. This makes instant mobile loans a convenient option for emergency financial needs.

Interest rates and repayment terms for instant mobile loans in Kenya vary among lenders, but they are typically higher than traditional bank loans due to the convenience and speed of access. Repayment terms are usually short, ranging from a few days to a month.

If you are unable to repay your instant mobile loan on time, you may incur additional fees and penalties. Some lenders may also report non-payment to credit reference bureaus, which could negatively impact your credit score and future loan eligibility.

Some lenders in Kenya may allow you to borrow multiple instant mobile loans simultaneously, depending on your creditworthiness and repayment history. However, it is important to borrow responsibly and avoid overextending yourself to prevent falling into a cycle of debt.